HAPI - An Ambitious Low Cap Fitting the Cybersecurity Narrative

HAPI partnered recently with TRON and all early investors token are unlocked.

HAPI is an on-chain cybersecurity protocol launched in 2021 that is gaining volume in the past weeks. They have currently a lot going on.

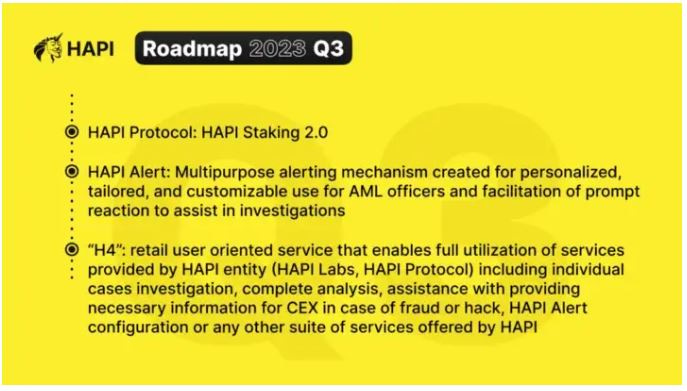

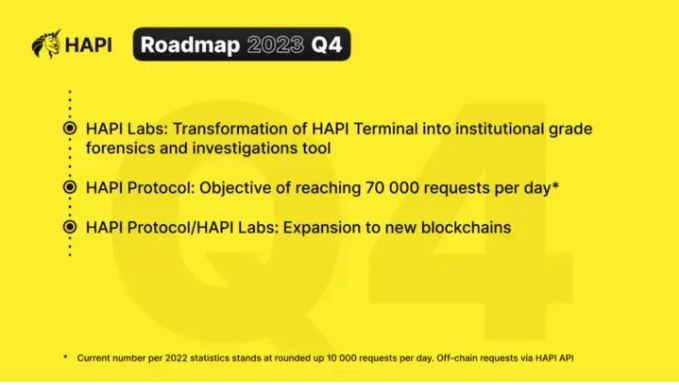

They announced a partnership with the blockchain TRON, achieved almost all the goals of their old roadmap and published a new roadmap for 2023. The roadmap is including a new staking mechanism for the token. Also vesting of early investor tokens is already done.

2x in December

This is all reflected in the recent price action, as the price of the $HAPI token did a 2x in December. The token price is currently ~$15 with a Mcap of $11 Million.

According to the Messari Crypto Report for 2023, solving security issues at scale will be a big narrative in the next cycle. This is why it might be good to have projects like HAPI or Lossless in our portfolio.

As I mentioned on Twitter, I noticed also that Binance is preparing for this narrative and investing in security protocols recently:

Without going into technical details, the use cases of HAPI sound similar to those of Lossless. Both projects offer threat monitoring and smart contract defence capabilities, designed to prevent exploits before they happen.

Token Utility - Staking and Payment Solution

The (planned) token utility of HAPI seems a bit stronger compared to LSS. While you can use the services of Lossless also without the token, HAPI plans to offer services, that are only available to $HAPI Holders:

As the team answered in a recent AMA:

“HAPI Token utility will include both B2B and B2C elements. Staking for reporters (both official as well as independent) still in the books. On top of that HAPI will be utilized as a reward for tracers. On top of that HAPI Labs Terminal will require Clients and customers to have HAPI in order to use it.

We also have comprehensive plans on extending the Customer side. We will be offering private investigation directly in the dashboard allowing any user to request a more detailed and deep analysis of their query (hack, exploit, social engineering, assistance in connecting them with CEXes etc.). Paid in HAPI.”

Team of Security Experts

The team is doxxed and from Ukraine. Part of the developers are working in a company called Pragma Technologies which is specialised in “building secure blockchain infrastructure for the decentralized finance domain”.

Vesting of Private and Public Tokens is completed

While the whitepaper shows a misleading vesting schedule, the admin in the telegram group assured me that the vesting is done and the remaining 262K token will only be used for farming.

This means there is no selling pressure from early investor token unlocks anymore. Furthermore if the staking begins, the circulating supply will be reduced temporarily.

Impressive Partnerships

The partnerships concluded to date are impressive. It seems HAPI is focussing on gaining partnerships with big blockchains and exchanges, like the recent partnership with TRON.

Investment Thesis

Short-Term: HAPI did already a 2x in December and is currently sitting below resistance at ~$15. If it can flip the resistance level and the hype stays a bit longer we could see a price of $21-25 or more in short term, if the market behaves.

Long-Term: DCA into the accumulation area in the next months between $5-10 should be a good strategy to accumulate a small bag for the next bull market.